Capital Readiness: Are You Prepared?

- CtoC Finance

- Aug 2, 2025

- 6 min read

What is Capital Readiness?

Imagine you're running a small lemonade stand.

You have big dreams of expanding your stand, buying more ingredients, and maybe even opening another one in a different location.

But to turn these dreams into reality, you need money – that's where raising capital comes in.

Raising capital is like asking for help to make your lemonade stand even better.

Instead of using only your own money (AKA, bootstrapping), you invite others to invest in your idea.

These could be friends, family, or people who believe in your stand's potential.

When they give you money, or loan it to you, sometimes they become "partners" in your business.

They believe that by helping you, they'll get something back in the future – it's like they're buying a small piece of your lemonade stand.

In return, you promise them a share of the profits your stand makes as it grows.

But remember, getting this help isn't always easy.

You need to show these potential partners that your lemonade stand is worth their money.

You might need to explain your plans for growth, show how much money you're making now, and convince them that your stand will become even more successful.

Raising capital is like getting a boost to help your lemonade stand reach new heights.

It lets you buy more lemons, fancier cups, and maybe even open a second stand.

Just remember, when you raise capital, you're not alone – you're getting support from people who believe in your dreams and want to see your business flourish.

Debt, Equity, or Hybrid?

Capital raising is a fundamental process in the financial landscape, enabling businesses to secure funds from external sources to achieve strategic goals and fuel growth.

This endeavor can encompass various avenues, such as enhancing business development, investing in assets like mergers and acquisitions (M&A), joint ventures, and strategic partnerships.

Strategically raising capital serves as a catalyst for companies to actualize their visions and expand their operations.

Capital raising comes in different forms, each with its own dynamics and implications.

Companies have three principal pathways: debt, equity, or hybrid options that combine elements of both debt and equity.

These strategies serve as the cornerstones of financing endeavors that empower companies to achieve their goals and propel their growth.

Debt raising involves sourcing funds through loans from external parties, typically financial institutions, or private equity funds.

While traditional lenders like banks and public debt markets remain integral to this process, the contemporary financial landscape has introduced a diverse range of lending entities.

Debt raising entails repaying the borrowed principal along with agreed-upon interest over the loan's duration.

The magnitude of the global debt market, valued at approximately $307 trillion (about $920,000 per person in the US) in 2023, underscores the diversity of debt raising options available.

Companies can access various forms of debt, each with distinct terms and conditions tailored to safeguard the lender's interests.

These forms include secured debt, unsecured debt, tax-exempt corporate debt, and convertible debt.

The choice of debt structure hinges on factors such as financial standing, credit history, collateral quality, and risk tolerance.

Debt raising offers companies many advantages, including rapid access to capital, cost-effectiveness in low-interest rate environments, predictability of interest payments for budgeting, and the tax deductibility of interest.

However, these benefits are counterbalanced by challenges such as potential credit rating reduction, the temptation to raise unnecessary debt, the obligation to repay even during business downturns, and limitations on strategic flexibility due to increased debt on the balance sheet.

Equity raising revolves around selling ownership shares in a company to investors in exchange for capital infusion.

Equity investors encompass a wide array of stakeholders with the requisite resources and interest in taking part based on valuation assessments.

Striking the right balance in equity valuation is pivotal, as overestimating a company's worth can deter potential investors seeking favorable returns on investment.

Equity raising encompasses various stages of a company's growth journey, ranging from crowdfunding and seed financing for startups to private equity and venture capital for emerging enterprises.

The most familiar avenue, the stock market, allows publicly listed companies to issue equity, raise funds and maintain liquidity.

This approach offers a range of benefits, including access to expert management advice, freedom from regular interest repayments, and the ability to set company valuations.

However, it also entails relinquishing some control over the business and sharing potential profits with external investors.

Hybrid capital raising can be a compromise, amalgamating the benefits and drawbacks of debt and equity strategies.

It affords flexibility to both companies and investors and potentially minimizes risks.

Depending on the agreement's structure, the hybrid model can provide advantages to either the company or the investor.

In cases where debt can be converted into equity, investors stand to gain if the company flourishes, while other structures primarily favor the company.

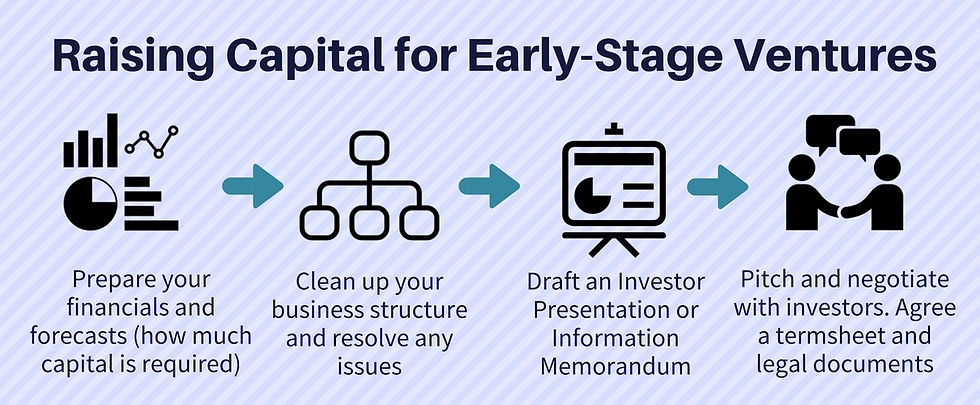

Whether a company opts for debt or equity capital raising, or both, it navigates a process much like selling a business in mergers and acquisitions.

The journey involves compiling vital documentation, accurately valuing the business, and ensuring organizational readiness.

Employing data room due diligence software streamlines this procedure by organizing capital raising efforts and highlighting potential vulnerabilities in a company's value proposition.

How to Choose the Appropriate Funding Source?

Traditionally, banks made up the primary capital source, particularly for debt financing.

However, the evolving financial landscape ushered in a diverse array of options for companies of all sizes.

Common avenues include:

Banks

A reliable source of both debt and equity financing, with equity raises being less frequent.

Private Debt

Non-public financial institutions offer private debt options, with interest rates variable depending on current market conditions.

Private Equity

Abundant private equity "dry powder" presents a prime avenue for equity capital, catering to companies of varying sizes.

Angel Investors/VCs

Equity investors offer capital, expertise, and networking opportunities for promising startups.

Public Markets

Companies can go public through Initial Public Offerings (IPOs) to raise equity capital and expand operations.

SBA

Small Business Administration loans provide attractive rates, though they may require more time to approve and release funds.

Capital raising approaches differ based on business size:

Startups

Early-stage companies rely on crowdfunding, seed financing, angel investment, and venture capital.

SMBs

Small and medium-sized enterprises access capital through private equity investors, family offices, and tailored financing.

Large Companies

Established enterprises opt for Initial Public Offerings (IPOs), private equity, family offices, and wealth funds.

Embarking on the capital raising journey demands meticulous preparation:

Clean Up the Financials

Enhance financial statements by addressing credit card debt, optimizing credit terms, and trimming operating expenses.

Craft a Comprehensive Business Plan

Develop a robust business plan or pitch deck that illustrates the need for capital, displays potential returns, and instills investor confidence in the company's longevity.

Emphasize Source and Use

Clearly delineate the purpose of the funds, whether for equipment acquisition, marketing expansion, or other initiatives.

Expand the List

Recognize the competitive landscape and understand that raising capital is a time-intensive process, involving multiple rejections before securing potential investors.

Emergency Planning

Having contingency plans and reserves to navigate unexpected challenges or disruptions.

Strategic Investments

Allocating capital wisely for growth opportunities that align with the business's goals.

Debt Management

Managing debt responsibly to avoid excessive financial burdens and maintain a strong credit profile.

Working Capital

Ensuring a healthy balance between current assets and liabilities for smooth day-to-day operations.

Cash Reserves

Having sufficient cash on hand to cover operational expenses and unexpected costs.

Growth is the linchpin behind capital raising initiatives across the business spectrum.

Irrespective of the company's stage or industry, the underlying motive invariably revolves around propelling growth.

This shared motive underscores the explicit reasons for capital raising:

Expanding Horizons

Funding allows businesses to broaden their reach, whether by hiring team members, acquiring competitors, or restructuring distressed operations.

Fueling Innovation

Capital infusion fuels innovation, enabling companies to develop new products, technologies, and services.

Enhancing Market Position

Raising capital empowers companies to enhance their market positions, capture new opportunities, and fortify their competitive edge.

Final Thoughts

Capital raising stands as the cornerstone of business expansion and development, offering companies the means to achieve strategic objectives and drive growth.

By understanding the intricacies of debt, equity, and hybrid financing, as well as the preparation needed for successful capital raising, businesses can navigate this transformative process with confidence.

With a diverse array of sources and strategies at their disposal, companies can harness capital to innovate, expand, and secure their foothold in the dynamic business landscape.

What steps are you taking today to get the funding your business needs?

~To the health & wealth of you, and your business~

Comments